If the employee salary is above 15000 Rs, still the employee and employer can contribute to the EPF scheme based on their mutual interest.įor employers, they must have minimum 10 or above employees to register their establishment under EPFO scheme 1952.Įvery employee whose monthly gross salary is below 21000 Rs will be eligible for ESIC scheme.įor employers they must have 10 or above 10 employees to register their establishment under ESIC scheme 1948. So overall 4% of employee gross salary will be paid towards ESIC account in every month.Įvery employee whose monthly basic wage + Dearness Allowances (DA) is below 15000 Rs will become eligible for the EPF scheme. ESI Calculation Formula Percentages 2021 ESI calculated on

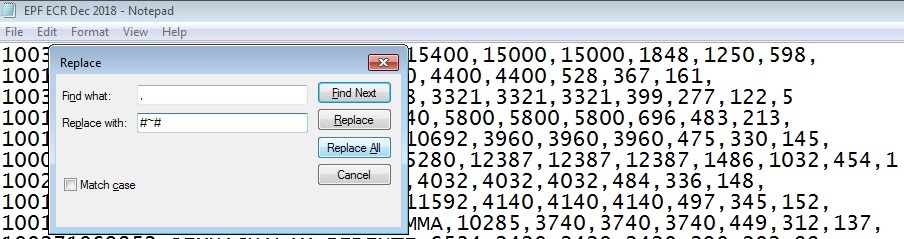

Note: If there is no DA then only basic wage is considered to calculate the EPF monthly contributions. So total employee will contribute 12% of basic wage + DA for PF and employer will pay 13% towards employee PF and pension accounts together. PF Calculation Formula Percentages 2021 PF calculated on Not only employees even employers can also use the above format to calculate the monthly contributions of employees towards PF and ESI. change the very first loop counts in you wish you change. Copy below given code and paste it in your VBA Module 1 a Explain in video. Follow the ECR Format as downloaded from Unified portal (PF Website) Fill the all columns e.g. The above excel format is updated as per the latest EPF and ESIC calculation formulas. How to use generate ECR text file from Excel: Steps. Download PF & ESI Calculation Excel Format 2021

0 kommentar(er)

0 kommentar(er)